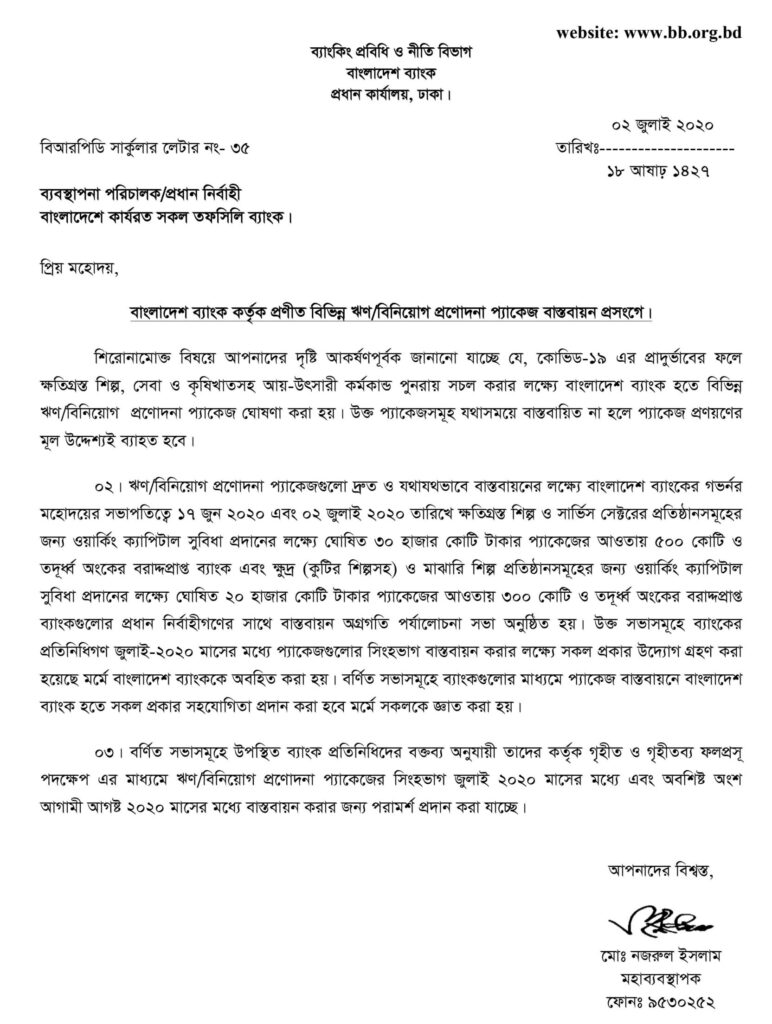

The Bangladesh Bank on 02 July 2020 cracked the whip on banks for their foot-dragging in implementing the stimulus packages for businesses, ordering them to disburse all funds within the next month.

The desired recovery from the ongoing economic fallout brought on by the coronavirus pandemic will not be possible if the stimulus package is not implemented on time, according to a central bank notice sent out to all lenders.

Lenders have been asked to implement the lion’s share of the stimulus packages within this month and the remaining portion by August.

The central bank came up with the decision after a virtual meeting with banks on 02 July 2020.

The managing directors of banks, whose portions of stimulus packages will depend on their past disbursement performance to respective sectors, took part in the meeting.

Banks have so far got approval from the BB to disburse loans worth Taka 4,100 crore under the stimulus package of Taka 30,000 crore for the large borrowers in the industrial and service sectors.

Small and medium enterprises have got nearly Taka 200 crore in SME loans from the central bank’s stimulus package of Taka 20,000 crore.

The central bank will provide half of the total amount of the two stimulus packages from its own sources in the form of refinance fund.

Businesses in the farm sector have so far managed to get only Taka 60 crore from the stimulus package of Taka 5,000 crore for them.

Marginal businesses have got only Taka 82 crore from the dedicated stimulus package for them.

The central bank will distribute the whole of Taka 8,000 crore of the two stimulus packages from its own sources by constituting separate refinance schemes.

Even though lenders have been showing a reluctant attitude in giving out loans, borrowers are repeatedly seeking funds from banks.

Lenders will get loans at the highest interest rate of 9 per cent from the package.

For instance, the SME clients can take working capital at 9 per cent interest from the stimulus package for the sector. Of the interest, 4 per cent will be borne by the borrowers and 5 per cent by the government.

The economy will not get the expected recovery from the ongoing meltdown if lenders continue to show unwillingness in implementing the packages, a central bank official said.

Some banks think that their disbursed loans will become defaults if they give out funds at this moment.

“But such a situation will create a vicious cycle for them. They will only protect their financial health by way of disbursing loans since this is the single path to ensuring desired profits,” the official said.