Enamul Hafiz Latifee compiles,

Vehicles were among the export sectors hit hardest by the coronavirus pandemic for the first 10 days in May, data from the Korea Customs Service showed Monday, 11 May 2020.

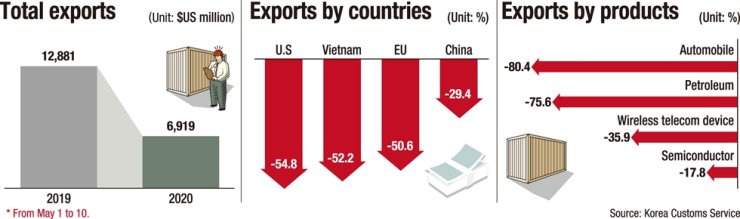

According to the customs authority, the nation’s vehicle exports dropped 80.4 percent from 01 to 10 May, compared with the same period last year, as economic shocks from the global spread of COVID-19 continue to remain serious.

Petroleum products and wireless telecommunication devices followed, with their exports plunging 75.6 percent and 35.9 percent, respectively, during the same period. Semiconductor exports also dropped 17.8 percent.

The shipbuilding industry was the only sector whose exports rose due to orders for large cargo ships during the period.

The sharp decline in major export items drove down total exports, which came in at $6.9 billion, a drop of 46.3 percent from the same period last year.

Data indicated the pandemic is worsening the nation’s export activities. In April, exports plunged 24.3 percent from the previous year.

By regions, Korea’s exports to major economic powerhouses ― such as China, the United States and Japan ― reported a two-digit decline in early May.

Exports to China, the biggest trading partner of Korea, declined 29.4 percent, while exports to the U.S. reported a bigger drop of 54.8 percent for the first 10 days in May. Exports to the European Union also fell 50.6 percent, and those to Vietnam also reported a similar level of decline at 52.2 percent.

The export shock was due to virus-induced disruptions in global supply chains. With the coronavirus shock bringing a longer-than-expected panic to the global economy, concerns are rising that the situation may get worse in the next few months.

“The economy will suffer huge setbacks in the second quarter due to the virus shock, as exports in May are likely to remain weak following the drop in April,” Yonsei University Economist Sung Tae-yoon said.

In Korea, new confirmed cases of the virus have been on a steep decline, but this is not the case in most Western countries ― such as the U.S. and Europe ― which is casting a murky outlook for a near-term rebound in Korea’s exports.

Sung went on to share his dim outlook regarding a rebound.

“The government cannot play any part in revitalizing falling exports at a time when most countries that import Korean products are reeling from the virus pandemic,” he said.

“For now, the best thing the government can do is to provide financial support and tax benefits to virus-hit local companies.”

The weakening overseas shipments are also expected to deal a severe blow to the nation’s GDP growth in 2020 due to its export-driven industrial structure.

Global ratings firms have also revised down their GDP growth forecast for Korea this year.

Fitch Ratings estimated Korea’s GDP will decrease by 1.2 percent in 2020, as the global spread of the coronavirus will continue to disrupt economic activities and financial markets here and abroad.

Last month, the International Monetary Fund (IMF) also shared the same outlook that the local economy would contract 1.2 percent this year in the aftermath of the virus-driven economic challenges facing the world.